Why the Biggest Risk Is Missing the Move

Another year, another success story: PGMs. I’ve been writing and speaking about PGMs for a couple of years now, but I became truly enthusiastic after attending Shanghai Platinum Week last year.

In our annual letter to partners in January 2025, I wrote:

“We continue to observe steady growth in demand for Platinum Group Metals (PGMs), while production continues to decline. Global inventories are approaching critical levels, and we believe it is only a matter of time before this situation becomes evident to all market participants. This scenario will likely require substantially higher prices to attract producer interest and justify investments in increased production.”

Lo and behold, platinum prices have skyrocketed this year, rising more than 120% at the time of writing (with a few days still left in the year). Stocks such as Valterra and Impala Platinum are up more than 200%. By any measure, this has been a very good year for PGMs.

Source: Bloomberg, L2 Capital

Those who have followed me for a while know that the most important metal to watch in the PGM space is rhodium. The reason is simple: there is no way to increase rhodium production without increasing production across the entire PGM complex. In addition, there is no liquid rhodium ETF from which market participants can withdraw metal when needed.

As a result, when demand for rhodium rises, as reflected in its price, it tends to spill over into the rest of the group, namely platinum and palladium.

Rhodium was the metal that initiated this rally, supported by developments in China, persistent deficits, and expanding use cases. In late February and early March, rhodium prices began to rise, while platinum only followed in mid-May. At present, rhodium appears to be taking a breather and trading sideways, which suggests that the recent jump in platinum prices must be driven by other factors.

The case for PGMs remains compelling, with the market entering its third consecutive year of deficit, although supply and demand are expected to be broadly balanced this year. Platinum mine supply is forecast to increase by 2% in 2026 compared with 2025, as some work-in-progress inventory is released. Recycling supply is projected to grow by 10% yoy, driven by higher prices that incentivize recyclers to sell recently acquired material. I have written extensively about recyclers before, so there is little value in revisiting that topic here.

Overall, total platinum supply is expected to rise by 4% year-on-year in 2026, while total platinum demand is forecast to decline by 6% year-on-year to 7,385 koz. After three years of significant deficits, the platinum market is expected to move closer to balance in 2026, with a modest surplus of approximately 20 koz.

As I often say, caution is warranted when relying too heavily on these forecasts. If there is no recession in 2026, which remains the base case for many forecasters in the sector, we could easily see another year of deficit, potentially pushing platinum to new highs.

Moreover, despite the recent rise in platinum prices, the platinum-to-gold ratio remains very low. It is worth remembering that platinum is roughly 15 times more scarce than gold, and China is increasingly settling contracts in yuan.

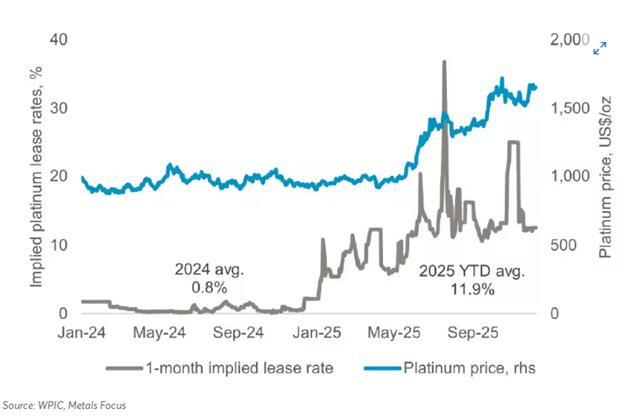

Finally, according to the WPIC, the implied one-month lease rate for borrowing platinum has surged from around 1% in 2024 to roughly 12% today. The primary driver is a lack of physical supply. This dynamic supports prices and, together with rising rhodium prices, marked the beginning of the bull market earlier this year.

In summary, the fundamentals supporting PGMs remain firmly in place. Structural supply constraints and tight physical availability continue to underpin the market. While consensus forecasts point to a more balanced platinum market in 2026, even a modest deviation in demand or supply could quickly return the market to deficit.

Against a backdrop of low inventories, rising lease rates, and historically depressed valuation metrics such as the platinum-to-gold ratio, the risk remains skewed to the upside. For investors willing to look beyond short-term volatility, PGMs might continue to offer a compelling opportunity, although the equities are 200% less interesting at this point.

As I often say, the greatest risk to my investment theses is not being invested when the market finally recognizes the underlying fundamentals. When that realization occurs, price adjustments tend to be swift and unforgiving, leaving little opportunity to build positions at attractive levels. In markets characterized by tight supply, low inventories, and limited liquidity, such as PGMs, moves are often abrupt rather than gradual, rewarding patience and conviction but penalizing hesitation.